How Many Years Of Income Tax Records Are You Required To Keep . No fraud was committed and all income was reported. tax records to keep for three years. Generally speaking, you should save documents that support any income and tax deductions and credits. if you fail to report all of your gross income on your tax returns, the government has six years to collect the tax or start legal proceedings. in most cases, you should plan on keeping tax returns along with any supporting documents for a period of at least three years following the date you filed or the. keep tax records for three years if: You filed a claim for. keep records for 3 years if situations (4), (5), and (6) below do not apply to you. Keep records for 3 years from the date you filed. keep records for six years if you do not report income that you should report, and it is more than 25% of the gross income shown on your. keep employment tax records for at least four years after the date that the tax becomes due or is paid, whichever is.

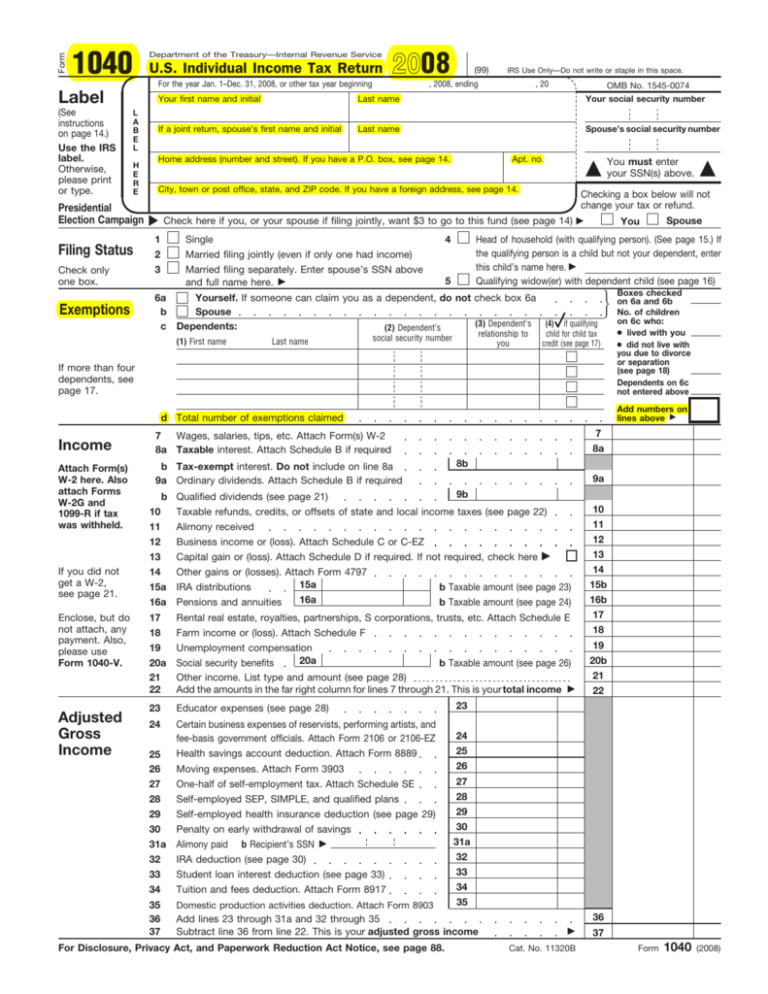

from 1044form.com

keep records for 3 years if situations (4), (5), and (6) below do not apply to you. Generally speaking, you should save documents that support any income and tax deductions and credits. keep tax records for three years if: You filed a claim for. tax records to keep for three years. keep records for six years if you do not report income that you should report, and it is more than 25% of the gross income shown on your. Keep records for 3 years from the date you filed. if you fail to report all of your gross income on your tax returns, the government has six years to collect the tax or start legal proceedings. keep employment tax records for at least four years after the date that the tax becomes due or is paid, whichever is. No fraud was committed and all income was reported.

1040 U S Individual Tax Return Filing Status 2021 Tax Forms

How Many Years Of Income Tax Records Are You Required To Keep keep employment tax records for at least four years after the date that the tax becomes due or is paid, whichever is. keep tax records for three years if: tax records to keep for three years. Keep records for 3 years from the date you filed. in most cases, you should plan on keeping tax returns along with any supporting documents for a period of at least three years following the date you filed or the. Generally speaking, you should save documents that support any income and tax deductions and credits. keep employment tax records for at least four years after the date that the tax becomes due or is paid, whichever is. keep records for six years if you do not report income that you should report, and it is more than 25% of the gross income shown on your. keep records for 3 years if situations (4), (5), and (6) below do not apply to you. if you fail to report all of your gross income on your tax returns, the government has six years to collect the tax or start legal proceedings. You filed a claim for. No fraud was committed and all income was reported.

From skysmartaccounting.com

How Long Should You Keep Your Tax Records SkySmart Accounting How Many Years Of Income Tax Records Are You Required To Keep in most cases, you should plan on keeping tax returns along with any supporting documents for a period of at least three years following the date you filed or the. You filed a claim for. keep tax records for three years if: keep employment tax records for at least four years after the date that the tax. How Many Years Of Income Tax Records Are You Required To Keep.

From 1044form.com

1040 U S Individual Tax Return Filing Status 2021 Tax Forms How Many Years Of Income Tax Records Are You Required To Keep Generally speaking, you should save documents that support any income and tax deductions and credits. if you fail to report all of your gross income on your tax returns, the government has six years to collect the tax or start legal proceedings. in most cases, you should plan on keeping tax returns along with any supporting documents for. How Many Years Of Income Tax Records Are You Required To Keep.

From www.hss-ca.com

How Long Do I Have to Keep My Business Tax Records? Hogg, Shain & Scheck How Many Years Of Income Tax Records Are You Required To Keep keep records for six years if you do not report income that you should report, and it is more than 25% of the gross income shown on your. if you fail to report all of your gross income on your tax returns, the government has six years to collect the tax or start legal proceedings. keep tax. How Many Years Of Income Tax Records Are You Required To Keep.

From bitcoinethereumnews.com

Here are the federal tax brackets for 2023 vs. 2022 How Many Years Of Income Tax Records Are You Required To Keep tax records to keep for three years. Keep records for 3 years from the date you filed. in most cases, you should plan on keeping tax returns along with any supporting documents for a period of at least three years following the date you filed or the. if you fail to report all of your gross income. How Many Years Of Income Tax Records Are You Required To Keep.

From mungfali.com

Historical Chart Of Tax Rates How Many Years Of Income Tax Records Are You Required To Keep Generally speaking, you should save documents that support any income and tax deductions and credits. keep records for 3 years if situations (4), (5), and (6) below do not apply to you. Keep records for 3 years from the date you filed. in most cases, you should plan on keeping tax returns along with any supporting documents for. How Many Years Of Income Tax Records Are You Required To Keep.

From www.wwltv.com

The History of Federal Tax Rates How Many Years Of Income Tax Records Are You Required To Keep Keep records for 3 years from the date you filed. in most cases, you should plan on keeping tax returns along with any supporting documents for a period of at least three years following the date you filed or the. No fraud was committed and all income was reported. keep records for six years if you do not. How Many Years Of Income Tax Records Are You Required To Keep.

From www.thewendyslaughterteam.com

How to “read” a tax record — The Wendy Slaughter Team at Elevate Real How Many Years Of Income Tax Records Are You Required To Keep No fraud was committed and all income was reported. keep tax records for three years if: You filed a claim for. keep records for 3 years if situations (4), (5), and (6) below do not apply to you. in most cases, you should plan on keeping tax returns along with any supporting documents for a period of. How Many Years Of Income Tax Records Are You Required To Keep.

From www.urban.org

How Federal Tax Rates Work Urban Institute How Many Years Of Income Tax Records Are You Required To Keep keep tax records for three years if: Keep records for 3 years from the date you filed. if you fail to report all of your gross income on your tax returns, the government has six years to collect the tax or start legal proceedings. Generally speaking, you should save documents that support any income and tax deductions and. How Many Years Of Income Tax Records Are You Required To Keep.

From www.youtube.com

Tax Return Filing Requirements Explained! (How To Know When To How Many Years Of Income Tax Records Are You Required To Keep keep records for six years if you do not report income that you should report, and it is more than 25% of the gross income shown on your. Keep records for 3 years from the date you filed. tax records to keep for three years. No fraud was committed and all income was reported. in most cases,. How Many Years Of Income Tax Records Are You Required To Keep.

From www.zbpforms.com

Tax Records Envelope for Tax Preparers How Many Years Of Income Tax Records Are You Required To Keep No fraud was committed and all income was reported. if you fail to report all of your gross income on your tax returns, the government has six years to collect the tax or start legal proceedings. Keep records for 3 years from the date you filed. keep records for 3 years if situations (4), (5), and (6) below. How Many Years Of Income Tax Records Are You Required To Keep.

From www.fastaccountant.co.uk

How Long Do You Need To Keep Tax Records In UK fastaccountant.co.uk How Many Years Of Income Tax Records Are You Required To Keep keep tax records for three years if: tax records to keep for three years. in most cases, you should plan on keeping tax returns along with any supporting documents for a period of at least three years following the date you filed or the. Keep records for 3 years from the date you filed. No fraud was. How Many Years Of Income Tax Records Are You Required To Keep.

From aseyeseesit.blogspot.com

Data Driven Viewpoints A 99 YEAR HISTORY OF TAX RATES IN AMERICA How Many Years Of Income Tax Records Are You Required To Keep keep records for six years if you do not report income that you should report, and it is more than 25% of the gross income shown on your. Generally speaking, you should save documents that support any income and tax deductions and credits. keep tax records for three years if: keep employment tax records for at least. How Many Years Of Income Tax Records Are You Required To Keep.

From timesofindia.indiatimes.com

So, what form do you need for your tax returns this year How Many Years Of Income Tax Records Are You Required To Keep keep employment tax records for at least four years after the date that the tax becomes due or is paid, whichever is. keep records for 3 years if situations (4), (5), and (6) below do not apply to you. No fraud was committed and all income was reported. Keep records for 3 years from the date you filed.. How Many Years Of Income Tax Records Are You Required To Keep.

From www.youtube.com

How To Look Up Tax Records Online? YouTube How Many Years Of Income Tax Records Are You Required To Keep keep records for six years if you do not report income that you should report, and it is more than 25% of the gross income shown on your. Generally speaking, you should save documents that support any income and tax deductions and credits. in most cases, you should plan on keeping tax returns along with any supporting documents. How Many Years Of Income Tax Records Are You Required To Keep.

From www.livefreemd.com

Historical Tax Rates Live Free MD How Many Years Of Income Tax Records Are You Required To Keep keep records for 3 years if situations (4), (5), and (6) below do not apply to you. keep records for six years if you do not report income that you should report, and it is more than 25% of the gross income shown on your. keep employment tax records for at least four years after the date. How Many Years Of Income Tax Records Are You Required To Keep.

From www.stlouisfed.org

The Purpose and History of Taxes St. Louis Fed How Many Years Of Income Tax Records Are You Required To Keep Generally speaking, you should save documents that support any income and tax deductions and credits. in most cases, you should plan on keeping tax returns along with any supporting documents for a period of at least three years following the date you filed or the. keep tax records for three years if: No fraud was committed and all. How Many Years Of Income Tax Records Are You Required To Keep.

From www.taxpolicycenter.org

Historical Highest Marginal Tax Rates Tax Policy Center How Many Years Of Income Tax Records Are You Required To Keep if you fail to report all of your gross income on your tax returns, the government has six years to collect the tax or start legal proceedings. No fraud was committed and all income was reported. in most cases, you should plan on keeping tax returns along with any supporting documents for a period of at least three. How Many Years Of Income Tax Records Are You Required To Keep.

From mungfali.com

Historical Chart Of Tax Rates How Many Years Of Income Tax Records Are You Required To Keep keep tax records for three years if: Generally speaking, you should save documents that support any income and tax deductions and credits. keep records for six years if you do not report income that you should report, and it is more than 25% of the gross income shown on your. keep employment tax records for at least. How Many Years Of Income Tax Records Are You Required To Keep.